Are you interested in forex trading but have been putting it off because you need to understand the terms and concepts fully? Do acronyms like PIP, spread, margin call, stop loss and trailing stop leave your head spinning? If so, keep reading. This article will answer your questions about what a PIP is and how better understanding it can help improve your success with forex trading.

By the end of this article, you’ll have a firm grasp of how to calculate a PIP rate for buying or selling currency on foreign exchanges. So whether you’re just starting in the world of forex trading or are an experienced trader wanting to brush up on your knowledge – this article has something for everyone.

Table of Contents

What is a PIP in forex trading, and what does it represent

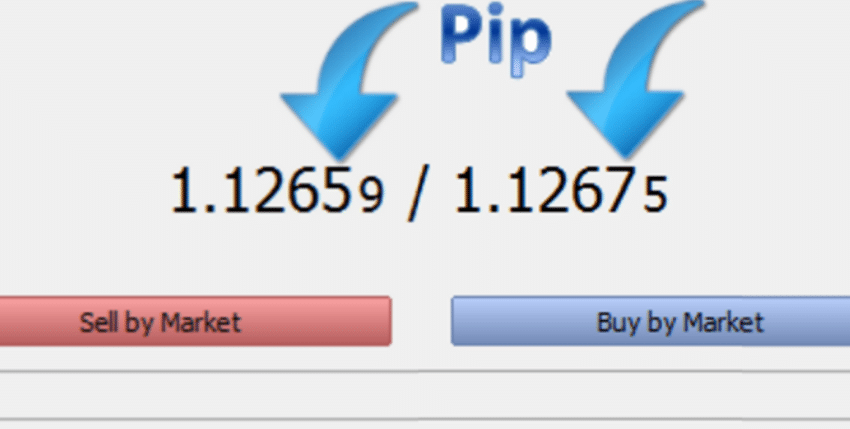

Forex trading uses a concept known as the pip, short for ‘percentage in point’. A PIP is a unit used to measure price movements in the currency exchange market and indicates a change in value between two currencies. Put another way; a PIP is the smallest increment by which an exchange rate can move up or down. When trading forex, keeping an eye on these incremental changes is essential because they can create lucrative opportunities.

For example, if you observe a trend in one currency appreciating against another, then you may be able to catch some of that movement and turn it into profits through well-timed trades. It may sound complex, but understanding how PIPs work is just taking the time to familiarise yourself with some of the basics of forex trading.

Benefits of brokers for forex trading with PIPs

To make the most of PIPs, it is worth considering brokers for forex trading who provide low spreads and leverage options. The spread is the difference between the bid (buy) price and the ask (sell) price for a given currency pair. When your broker offers you a lower spread, you reduce the amount of money you lose with each trade.

In addition, trading forex with a broker can give you leverage. Leverage allows you to increase the size of your trades by borrowing funds from your broker and amplifying your trading position – or losses – accordingly. It is important to use leverage responsibly, as it can also help you quickly build up losses if the market moves against you.

Finally, a good forex broker should also provide you with trading tools, such as automated trading software and mobile apps. These can help in your market analysis, which you can use to inform your decision-making when making trades.

How do PIPs impact your profit/loss in a trade?

When calculating what you gain or lose in forex trading, the PIP rate is what you need to look at. This figure will show you how much your gains or losses are worth per one unit of movement in the exchange rate on the foreign currency pair that you’re trading.

For example, let’s say you’re trading the EUR/GBP currency pair. If the exchange rate moves from 0.8800 to 0.8820, that is an increase of 20 PIPs – so what you gain or lose would be calculated based on whether you bought or sold at each rate and how many units of currency you were trading with.

It’s worth noting that the value of a PIP can differ depending on the currency pair you’re trading and the amount you are trading concerning your account balance. Taking these factors into consideration can help you when it comes to calculating your advantage and opportunities on a given trade.

Calculating PIP value and how it affects your bottom line

Now that you have a better understanding of what a PIP is, you also need to know how to calculate the value of each one.

The first step is to work out the lot size. It is simply the number of currency units you’re trading, ranging from 1,000 to 100,000, depending on your broker and the currency pair you’re trading.

From there, it’s simply a matter of multiplying the lot size by the PIP rate and then dividing that number by 10 to get the value of each PIP. For example, if you’re trading EUR/GBP at a rate of 0.8800 with a lot size of 10,000, then the PIP value would be 0.8 x 10,000 = 8,000/10 = 800.

This calculation can help determine how much money you make or lose on each trade concerning the exchange rate movements. It can also guide your decision-making regarding placing your stop losses and taking profit orders – so it’s essential to get comfortable with PIPs and how they impact your bottom line.