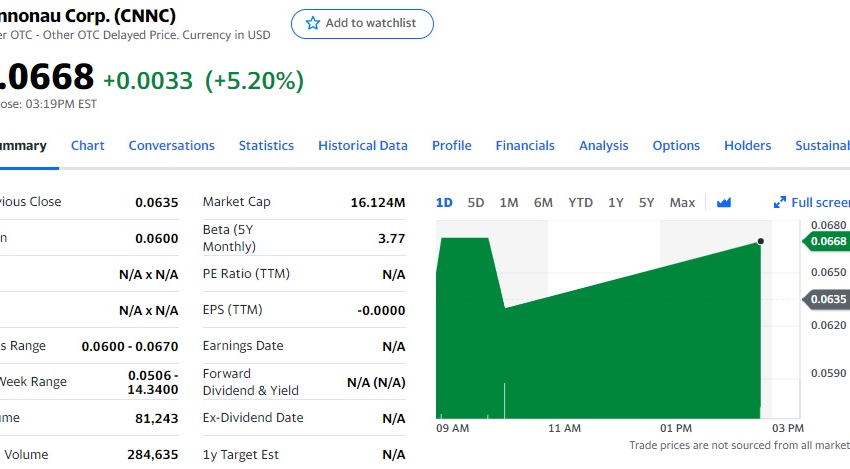

CNNC stock continues to trend lower as the price is trading between support and resistance levels. The company’s price is averaging $0.06 per share and has declined for three consecutive days. There is a high probability that this downward trend will continue as 79 out of 100 cases showed further declines within the month. At the end of December, the company reported a -8% downtrend. However, the next week’s report announced an uptrend of about 4%.

The stock price of CANNON CORP has increased 3.57% in the past five trading days. The average daily volume is 150289 shares. In contrast, it experienced a drawdown of -24.5% in the same period. It’s a high risk investment to buy CANNON CORP stocks because the market is highly volatile. For example, a company’s stock price may drop by 10% in a week.

Investing in the stock of a company with a track record of success may help you make money. If you’re a smart investor, you will have a solid portfolio with the right mix of stocks. If you’re worried about your investments, you should consider buying CANNON CORP (CNC) when the price goes up. However, you should also be aware of the risks. A bad investment can result in huge losses.

A good way to evaluate the risk of a specific investment is to read the company’s financial statements. They often provide information about a company’s history and the current situation. A well-written corporate report is an important tool to help investors analyze a stock’s performance. If you’re unsure of how to invest in a particular stock, it is a good idea to consult with a financial advisor before you invest your hard-earned money.

A company’s history can affect its stock price. As a result, it is wise to understand the fundamentals of a company before investing. Its financial statements are a good indicator of a company’s health. It’s important to know about a company’s history and understand how it compares to its competitors. You should also research the companies’ past performance. The past performance of a stock can have a significant impact on its future value.

Cannonau Corp. stock or CNNC Stock is making gains in the marijuana industry. Its estimated market value is $6.7 billion, which is up 47% a year. Its popular cannabis brands are appealing to millennials, which is why Cannonau is a good bet for marijuana stocks. The cannabis industry is becoming more mainstream, and investors should consider a company’s history. This will help you make informed decisions on which stocks to invest in.

Investing in cannabis companies is an exciting prospect. Canada and other states have legalized marijuana. This will increase the popularity of cannabis. There are also a variety of other industries that are related to marijuana. Among them, there is Cannonau. While this stock has been a popular choice for investors, it has recently become an undervalued one. The company’s growth has been pushed up by the popularity of its marijuana brands, and the company’s valuation has doubled over the past year.

Investing in Cannonau Corp. is a great choice for marijuana investors. It is a rising cannabis industry. The stock is making gains as more states legalize recreational cannabis. With the company’s estimated market value of $6.7 billion, it will grow at a 47% CAGR. The firm’s popularity is a testament to the changing social attitudes towards marijuana and its brands. If you are interested in cannabis and its industry, you should consider buying this company’s share.

The Cannonau Corp. stock’s alpha and beta are both important measures of the company’s performance in the market. The stock’s beta is its beta, which measures its performance against the market. This ratio is important for evaluating a firm’s profitability. The alpha of a stock is an indicator of its volatility. The price of a particular company is high when the security is performing well.

You may also like – CMC Stock