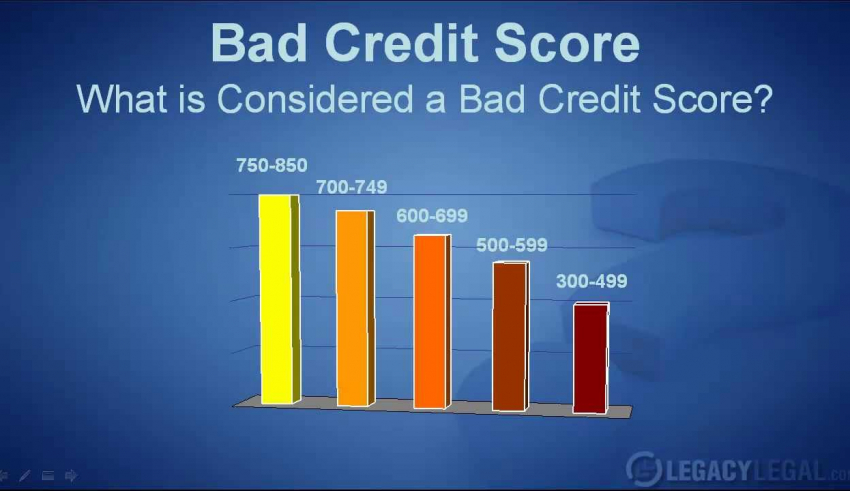

Lucia Jensen, co-founder from WeLoans, said that “Bad credit is the bane of many people’s financial existence. It can keep you from getting into a new home or from finding a job. If you’re wondering if you can ever improve your bad credit, the answer is yes. A bad credit score can be fixed, but it’s not going to happen overnight. You’ll spend weeks, if not months, working on the problem. But if you’re determined, you’ll find ways to improve your credit score so you can get the life you want.”

Unless you’re a rock star or a celebrity, it’s unlikely you’ll be approved for a no credit check loan to pay for a new car, a home, or for business expenses. People with bad credit scores often have loads of debt, a history of late payments, or both. But despite the challenges, it is possible to improve a bad credit score. In fact, you can find few things that you can do to help boost your score here.

What is the difference between a hard inquiry and soft inquiry of a credit report?

A hard inquiry (or hard pull) is when a business or lender looks at your credit report to make decisions about your creditworthiness. A soft inquiry (or soft pull) is when a business or lender looks at your credit report in order to pre-approve you for a specific product or service. This pre-approval doesn’t affect your credit score because it doesn’t involve a decision being made about your creditworthiness.

A hard credit inquiry is one that can potentially have an impact on your credit score. In most cases, you can expect your score to be impacted negatively for a short period of time, but as long as you stay on top of your credit score, the impact should be short-lived. A soft credit inquiry doesn’t affect your score, but it is something you should still be aware of, as it is a request to view your credit report.

A soft inquiry doesn’t actually show your credit report to the party who requested it, it simply allows them to look at it. These loans are also available for people who have a credit history but are looking to rebuild their credit. Since getting a bad credit loan is a process that involves a fair amount of legwork, you want to be sure you know what you’re getting into. If you are, in fact, dealing with bad credit, you’ll want to be cautious about your inquiries.

A credit inquiry is a request for your credit history. When you apply for credit, this is the stuff that lenders will want to see. They’ll get a copy of your credit report and use that to determine whether you’ll make a good investment or not.