A credit score is undoubtedly one of the crucial financial ‘assets’ you can have in life. Over the last decade, its importance has been gradually increasing as banks, fintech, NBFCs etc., take it as a parameter to judge your credibility and the likelihood of defaulting/paying your loan or card payments timely in future. But with the rise in the significance of credit score, isn’t it crucial to understand the entire concept of credit score, credit bureaus and the importance of credit history check? Let’s deep dive and explain it to you.

Table of Contents

What is a credit score exactly?

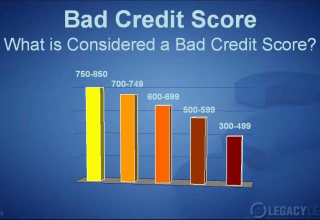

This three-digit summary of your credit history typically ranges from 300 to 900 points, with higher values indicating better credit.

Your creditworthiness and repayment behaviour are reflected by how successfully you have managed your prior debt repayments, such as credit card payments and loan EMIs.

How can you examine your credit score?

You may either obtain your credit score directly from the credit bureau or check it on one of the several online financial portals.

At least once a year, customers should request a free credit score and report from each credit agency in India. These include CIBIL, CRIF High Mark, Experian and Equifax). This will enable them to receive one complimentary credit score from each of India’s four credit bureaus.

What parameters are considered that affect credit score? Although each credit agency has its own set of scoring guidelines, they all examine your credit utilisation ratio, the balance of credit mix, credit history check, and a number of credit inquiries when computing your credit score.

What if the credit score is on the lower side?

Given that your credit score is one of the essential elements lenders assess when reviewing your application, they are likely to offer favourable terms and conditions as well as a broader selection of options to clients with a strong credit rating.

Lenders frequently favour consumers with credit scores of 750 or higher when extending credit, indicating that having a score below this threshold can diminish your chances of being approved for a loan.

Because borrowers with low credit are more likely to default on their debts in the future, they offer a bigger risk to lenders and are either granted loans with higher interest rates or have their applications denied outright.

Can you anticipate paying less interest on our loan if you have a high credit score?

Due to the fact that a good credit score indicates disciplined repayment behaviour in the past and a lower probability of default in the future, lenders are more inclined to favour borrowers with good credit scores and accept loan and credit card applications more swiftly.

Some lenders have begun offering credit risk-based pricing on loans, where the interest rate is determined by the applicant’s credit profile as opposed to standard pricing. Upon credit history check, those with a strong credit history may qualify for a loan with a reduced interest rate, which reduces the total cost of the loan. For instance, the State Bank of India and the Union Bank of India have implemented credit-based interest rates on new auto loans and home loans, respectively.

Do debit and prepaid cards affect one’s credit score?

The usage of debit or prepaid cards has no effect on a person’s credit score.

Does making an advance payment on a loan affect your credit score?

No, paying off your existing loan early will not negatively affect your credit score.

Does a person’s family history affect his or her credit score?

No. Your credit score is unaffected by your family’s credit history or credit profile, and credit bureaus do not take this into consideration during calculation.

However, if you have agreed to be a co-signer/guarantor for some loan, note that you are jointly and severally responsible for ensuring that the debt is repaid on time. Your credit score will be negatively impacted as a co-signer or guarantor if the primary borrower does not timely make loan payments or, at worse, defaults on loan.

Does credit score also depend on his or her income?

Your monthly income has no bearing on your credit score.

What is a credit report exactly?

A summary of the credit history is contained within your credit report. That is why a credit history check is done through the evaluation of the credit report. This includes information regarding outstanding loans, previous credit accounts, and current credit card balances. All of these factors are taken into account when determining your credit score.

What is involved in creating a credit report?

This means that the entirety of your credit report, including your current and outstanding loans, is based on information provided by your creditors and credit card company.

How can one’s credit report be obtained?

Every citizen in our country is obligated to receive a free credit score report at least once a year from each of the four credit bureaus. When getting free credit reports, individuals should distribute their requests such that they receive one report every calendar quarter.

Additionally, consumers can visit online financial portals to acquire a free credit score report and monthly updates to their credit ratings.

What happens if your credit report has certain errors?

Because credit reports contain credit information given by lenders, the presence of any error due to the lender or the credit bureau mistake can have a negative impact on your credit score and eligibility for future loans and credit card prospects.

Notify your lender and the appropriate credit bureau as soon as possible if you uncover an error or even fraudulent activity on the credit report so that the error can be rectified. Following the rectification process, your credit report would certainly reflect your new credit score.

It is advised that you regularly monitor your credit report to ensure that any inaccuracies or fraudulent activity are not overlooked and that your credit score is not at all negatively impacted. This will aid in the prompt detection and correction of any errors or potential frauds on your credit report.